Incorporating hard cash straight to your account. Bear in mind contributions are topic to yearly IRA contribution limitations set with the IRS.

Opening an SDIRA can present you with use of investments Ordinarily unavailable via a financial institution or brokerage agency. Listed here’s how to begin:

As soon as you’ve identified an SDIRA service provider and opened your account, you might be thinking how to actually get started investing. Comprehension both The principles that govern SDIRAs, together with how you can fund your account, can assist to put the muse to get a future of profitable investing.

IRAs held at banks and brokerage firms offer limited investment options for their consumers given that they don't have the experience or infrastructure to administer alternative assets.

Being an Trader, nonetheless, your choices are usually not limited to shares and bonds if you select to self-immediate your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Generating the most of tax-advantaged accounts enables you to maintain much more of The cash that you choose to devote and gain. Based upon irrespective of whether you end up picking a conventional self-directed IRA or perhaps a self-directed Roth IRA, you've the prospective for tax-no cost or tax-deferred development, furnished particular problems are fulfilled.

Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the objective of creating fraudulent investments. They often idiot investors by telling them that Should the investment is accepted by a self-directed IRA custodian, it have to be legitimate, which isn’t real. All over again, Be sure to do extensive homework on all investments you choose.

No, You can not invest in your very own business using a self-directed IRA. The IRS prohibits any transactions concerning your IRA and your very own small business as you, as the owner, are regarded as a disqualified human being.

SDIRAs are sometimes used by arms-on buyers who are willing to take on the dangers and responsibilities of choosing and vetting their investments. Self directed IRA accounts can even be perfect for traders who may have specialized information in a niche market which they wish to invest in.

The key SDIRA guidelines from the IRS that buyers need to have to know are investment restrictions, disqualified people, and prohibited transactions. Account holders should abide by SDIRA procedures and restrictions to be able to maintain the tax-advantaged status of their account.

Minimal Liquidity: Most of the alternative assets that can be held within an SDIRA, like real estate, personal fairness, or precious metals, will this post not be easily liquidated. This may be an issue if you'll want to accessibility cash swiftly.

Have the freedom to invest in Practically any sort of asset which has a danger profile that fits your investment method; like assets which have the probable for the next charge of return.

Research: It can be called "self-directed" for a motive. With an SDIRA, you might be fully responsible for extensively investigating and vetting investments.

Therefore, they tend not to market self-directed IRAs, which provide the flexibility to speculate within a broader selection of assets.

Consider your Buddy could possibly be commencing another Fb or Uber? With the SDIRA, you are able to spend money on triggers that you suspect in; and perhaps appreciate bigger returns.

Entrust can support you in paying for alternative investments with your retirement money, and administer the getting and marketing of assets that are usually unavailable by means of banking institutions and brokerage firms.

Place just, should you’re trying to find a tax productive way to construct a portfolio that’s much more tailored to your pursuits and skills, an SDIRA may be the answer.

This incorporates knowing IRS restrictions, running investments, and keeping away from prohibited transactions that could disqualify your IRA. An absence of information could bring about expensive errors.

Consumer Support: Look for a supplier which offers focused aid, including usage of educated specialists who can answer questions on compliance and IRS rules.

Jaleel White Then & Now!

Jaleel White Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Robbie Rist Then & Now!

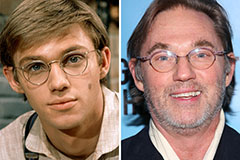

Robbie Rist Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!